Dogecoin, the meme-inspired cryptocurrency that started as a joke, has evolved into a serious investment opportunity for many around the globe. In South Africa, where innovative minds blend with abundant energy resources, maximizing returns on Dogecoin mining investments demands a strategic approach. Picture this: vast landscapes dotted with high-tech mining rigs humming under the African sun, turning digital coins into tangible profits. This article delves into the nuances of Dogecoin mining, exploring how to leverage mining machines and hosting services to outpace the competition.

At its core, Dogecoin mining involves solving complex cryptographic puzzles to validate transactions on the blockchain, much like its counterparts Bitcoin and Ethereum. Unlike Bitcoin’s energy-intensive proof-of-work system, Dogecoin offers a more accessible entry point for newcomers, with lower hardware requirements that can still yield impressive returns. In South Africa, where electricity costs are relatively affordable compared to Europe, enthusiasts are flocking to set up operations. Imagine rows of sleek mining machines, their fans whirring like a symphony, churning out Dogecoins amidst the backdrop of Table Mountain. Yet, success isn’t guaranteed; it hinges on understanding market volatility and selecting the right equipment from reputable sellers specializing in mining machines.

Transitioning to the hardware side, investing in top-tier mining machines is crucial. These powerful devices, often equipped with ASIC chips, are designed specifically for cryptocurrencies like Dogecoin, outperforming general-purpose GPUs used in Ethereum mining. Companies that sell and host these machines provide a lifeline for investors lacking the space or expertise to manage their own setups. In South Africa, opting for hosted mining services means your rigs are maintained in secure facilities, or mining farms, where cooling systems and stable power grids ensure optimal performance. This not only reduces operational headaches but also amplifies returns by minimizing downtime—after all, every second counts in the fast-paced world of crypto.

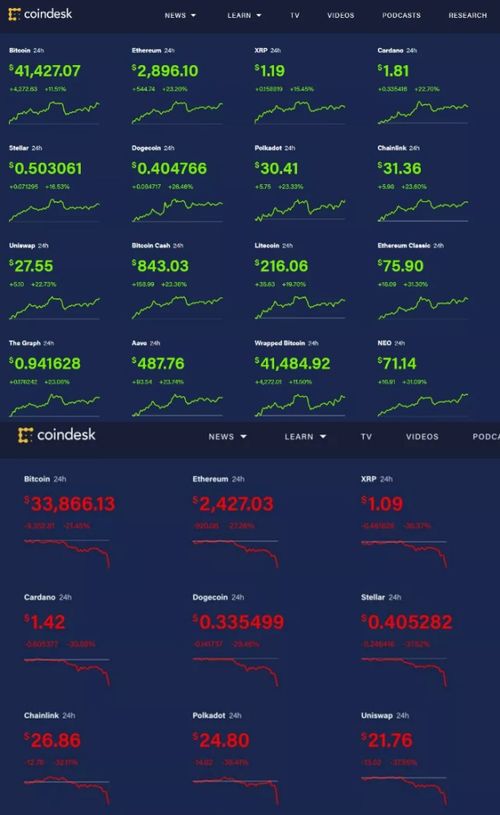

Now, let’s compare Dogecoin with heavyweights like Bitcoin and Ethereum to gauge its investment appeal. While Bitcoin remains the gold standard, its mining difficulty has skyrocketed, making it less profitable for small-scale operators. Ethereum, on the other hand, is shifting towards a proof-of-stake model, which could render traditional mining rigs obsolete. Dogecoin, with its inflationary supply and community-driven ethos, presents a refreshing alternative. In South Africa, where economic instability has pushed many towards alternative assets, Dogecoin’s lower entry barriers make it ideal. Investors can diversify by allocating resources across these currencies, perhaps using profits from Dogecoin to bolster Bitcoin holdings via local exchanges.

Exchanges play a pivotal role in this ecosystem, serving as the bridge between mining outputs and real-world value. Platforms like Binance or local South African exchanges allow miners to trade Dogecoins swiftly, capitalizing on price surges driven by social media hype. But beware: the crypto market is as unpredictable as a safari adventure, with sudden dips that can erode gains overnight. To maximize returns, savvy investors in South Africa focus on timing their sales, perhaps after a major blockchain event, while keeping an eye on regulatory changes that could impact mining operations.

One cannot overlook the importance of energy efficiency in this equation. South Africa’s energy landscape, bolstered by initiatives in renewable sources, offers a competitive edge for mining farms. By choosing energy-efficient miners, investors can slash costs and boost profitability. Picture a modern mining rig, compact yet formidable, silently processing transactions while sipping power— a far cry from the outdated models that guzzle electricity like an thirsty elephant. Hosting providers often bundle these efficient machines with comprehensive services, ensuring your investment in Dogecoin mining doesn’t become a financial burden.

To truly maximize returns, adopt a multifaceted strategy. Start by educating yourself on blockchain technology, perhaps joining local crypto communities for insights on the best mining machines. Diversify your portfolio beyond Dogecoin, incorporating stakes in Ethereum or Bitcoin to hedge against risks. In South Africa, take advantage of government incentives for tech innovation, which could include tax breaks for green energy usage in mining. Remember, mining is not just about hardware; it’s about foresight, adaptability, and a dash of luck in the ever-shifting crypto tides.

In conclusion, Dogecoin mining in South Africa holds immense potential for those willing to navigate its challenges. By investing wisely in mining machines and leveraging hosting services, you can turn this playful currency into a powerhouse of returns. As the sun sets over the savannas, your rigs could be the ones lighting the path to financial independence, blending technology with opportunity in a truly African crypto renaissance.

Leave a Reply