The allure of digital gold, the promise of decentralized finance, and the whisper of passive income – these are the siren songs drawing UK users into the intricate world of cryptocurrency mining. But navigating this landscape requires more than just enthusiasm; it demands a strategic approach, a deep understanding of the tools of the trade, and a keen awareness of the fluctuating market conditions. This isn’t simply about plugging in a device and watching the satoshis accumulate; it’s about optimizing your setup for maximum efficiency and profitability in the competitive UK environment.

At the heart of any successful mining operation lies the mining rig itself. For Bitcoin (BTC) mining, Application-Specific Integrated Circuits (ASICs) reign supreme. These specialized machines are designed for one specific task – solving the complex cryptographic puzzles that secure the Bitcoin network and reward miners with new coins. Leading manufacturers like Bitmain, MicroBT, and Canaan offer a range of ASICs, each boasting different hash rates (a measure of computational power) and energy consumption levels. Selecting the right ASIC involves a careful balancing act between upfront cost, power efficiency, and anticipated profitability, considering the ever-increasing difficulty of the Bitcoin network.

Beyond Bitcoin, other cryptocurrencies like Ethereum (ETH) (although its mining landscape has changed significantly with the move to Proof-of-Stake) and Dogecoin (DOGE) can be mined using Graphics Processing Units (GPUs). GPU mining offers greater flexibility, as these cards can be repurposed for other tasks, such as gaming or video editing, should mining profitability decline. Building a GPU mining rig involves selecting a motherboard, CPU, RAM, and multiple high-end GPUs, along with a power supply capable of handling the substantial energy demands. Optimizing GPU settings, such as core clock and memory clock speeds, is crucial for maximizing hash rate and minimizing power consumption.

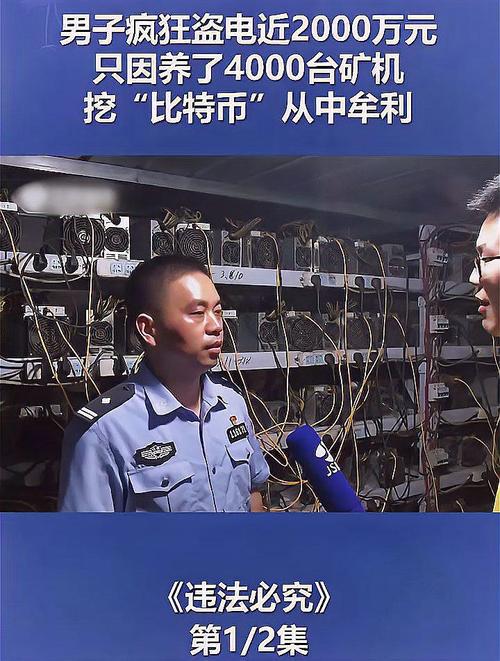

Choosing the right location for your mining operation is also paramount, especially in a country like the UK with varying electricity costs. Factors to consider include access to affordable electricity, stable internet connectivity, and adequate cooling infrastructure. Mining generates significant heat, and without proper ventilation, your equipment can overheat and suffer performance degradation or even permanent damage. Some miners opt for specialized mining farms, which offer managed hosting services, including power, cooling, and security, allowing them to focus on optimizing their mining strategies.

Speaking of hosting, mining machine hosting is an increasingly popular option for UK users looking to avoid the complexities of managing their own equipment. Hosting providers offer a range of services, from basic colocation (simply providing space and power) to fully managed solutions that include maintenance, monitoring, and optimization. When selecting a hosting provider, it’s crucial to consider factors such as uptime guarantees, security measures, and the provider’s reputation. Don’t underestimate the importance of a strong Service Level Agreement (SLA) that clearly outlines the provider’s responsibilities and your recourse in case of service disruptions.

Navigating the cryptocurrency exchange landscape is another essential skill for successful miners. Exchanges are the gateways for converting mined coins into fiat currency (like GBP) or other cryptocurrencies. Different exchanges offer different trading pairs, fees, and security features. It’s important to research and choose reputable exchanges with robust security measures to protect your digital assets. Furthermore, understanding the tax implications of mining and trading cryptocurrencies is crucial for staying compliant with UK regulations. Consult with a qualified tax advisor to ensure you are fulfilling your tax obligations.

The profitability of cryptocurrency mining is highly dependent on factors such as the price of the cryptocurrency, the mining difficulty, and the cost of electricity. Regularly monitoring these variables is essential for making informed decisions about when to mine, what to mine, and when to sell your mined coins. Joining online mining communities and forums can provide valuable insights into market trends and best practices. Learning from experienced miners can help you avoid common pitfalls and maximize your returns.

Beyond the hardware and the hosting, the software side of mining is equally important. Mining software connects your mining rig to the cryptocurrency network and allows you to participate in the mining process. Different cryptocurrencies require different mining software, and it’s essential to choose software that is compatible with your hardware and operating system. Popular mining software options include CGMiner, BFGMiner, and EasyMiner. Configuring your mining software correctly is crucial for achieving optimal hash rates and minimizing errors.

Finally, remember that cryptocurrency mining is a constantly evolving field. New technologies, new cryptocurrencies, and new regulations are constantly emerging. Staying informed and adaptable is essential for long-term success. Embrace continuous learning, experiment with different strategies, and never stop optimizing your setup. The rewards of successful cryptocurrency mining can be significant, but they require dedication, knowledge, and a willingness to adapt to the ever-changing landscape.

Leave a Reply to Phala Cancel reply